Buying a resale Executive Condominium (EC) in Singapore is a strategic choice for those looking for an affordable and flexible housing option. Prospective buyers should familiarize themselves with the unique eligibility criteria for EC purchase, including income ceiling restrictions and the 'Three Months Rule.' Financial planning is key, as buyers can leverage various specialized home loan packages from banks and financial institutions, with competitive rates and tailored repayment terms. It's beneficial to consider government housing grants that can assist with the downpayment. The transition period before an EC becomes a private condo, typically after 10 years or upon reaching 75% sold, presents a cost-effective opportunity for early purchase.

Navigating the resale EC market requires understanding the distinct mortgage processes due to its position between public and private housing. Buyers must evaluate their financial standing, including income, debts, and credit health, to determine the loan-to-value (LTV) ratio and interest rates. Extra costs like Legal & Certificate Fees should be budgeted for. It's important to comply with regulations such as the Total Debt Servicing Ratio (TDSR) and Mortgage Service Ratio (MSR) to avoid disruptions during the loan application process.

Those considering a resale EC in Singapore should engage with mortgage brokers or financial advisors who can guide them through the complex application process, from eligibility verification to legal and valuation stages. This ensures a smooth transaction and supports buyers in securing an EC that meets their lifestyle and financial goals without compromising on comfort, amenities, or location. The process is streamlined by understanding the market, comparing loan packages, and ensuring all documentation is in order for approval. With careful planning and professional advice, purchasing a resale Executive Condominium can be a rewarding and cost-effective step into homeownership in Singapore.

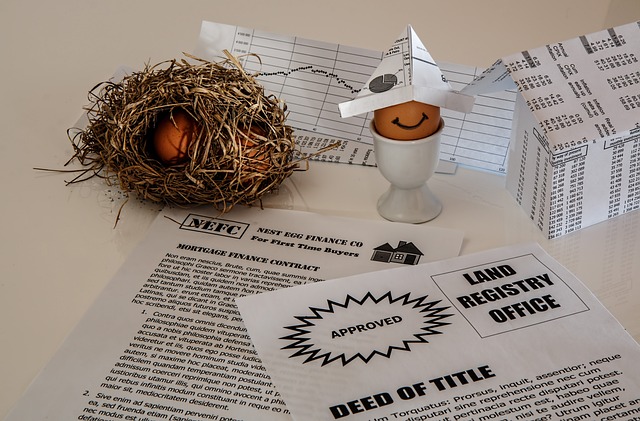

Exploring the nuances of the Executive Condo (EC) resale market in Singapore presents a prudent move for homebuyers. This article delves into the intricacies of purchasing a resale EC, focusing on the diverse financing options available to buyers in this niche segment of the housing market. We’ll navigate through the key loan alternatives, tailored for those looking to buy a resale Executive Condo in Singapore, and provide a comprehensive guide to secure an EC resale mortgage with confidence. Whether you’re a first-time buyer or an experienced investor, this article is your essential resource for understanding the financial landscape of EC resale transactions.

- Understanding Executive Condo (EC) Resale Market in Singapore

- Financing Your Purchase: EC Resale Loan Options in Singapore

- Key Considerations When Applying for an EC Resale Mortgage

- Step-by-Step Guide to Securing an EC Resale Loan in Singapore

Understanding Executive Condo (EC) Resale Market in Singapore

In Singapore, the Executive Condominium (EC) resale market presents a unique opportunity for prospective homeowners to purchase pre-owned units that blend the benefits of condo living with the affordability of public housing. Unlike new ECs, which are sold directly by developers, resale ECs offer a varied selection of properties in established neighborhoods, allowing buyers to inspect and assess the property before making a commitment. The resale market is a testament to the popularity and enduring appeal of ECs as a housing option for both young families and upgraders from HDB flats. Prospective buyers interested in ‘Buying Resale Executive Condo Singapore’ should consider factors such as the property’s age, condition, location, and proximity to amenities, as these can influence both the resale price and the living experience. It’s also crucial to be well-versed with the eligibility criteria for purchasing an EC, which includes income ceiling requirements and the ‘Three Months Rule’ where applicants must have not disposed of a flat within the preceding three months from the application date. By understanding these nuances, buyers can navigate the resale EC market more effectively, securing a property that aligns with their lifestyle needs and financial considerations. For those considering this path, it’s advisable to engage with real estate professionals who specialize in EC transactions to gain insights into the best available options and to facilitate a smooth buying process.

Financing Your Purchase: EC Resale Loan Options in Singapore

In the dynamic property market of Singapore, purchasing a resale Executive Condominium (EC) presents a unique opportunity for aspiring homeowners. Financing such a purchase can be navigated through various loan options tailored to meet individual financial scenarios. For those looking to buy a resale EC in Singapore, understanding the available financing routes is crucial. Banks and financial institutions offer competitive home loan packages specifically designed for ECs, which are different from HDB loans. These packages often come with flexible repayment terms and interest rates that cater to the varying needs of buyers. Moreover, as ECs transition from public to private housing after 10 years or when 75% of the units in the development have been sold, potential buyers can capitalize on the initial affordability before the transition. It’s important for prospective buyers to assess their financial situation and eligibility criteria set by these institutions early in the buying process to secure favorable loan terms. Additionally, the Singaporean government has schemes like the CPF Housing Grant for eligible applicants, which can significantly subsidize the downpayment required, thereby making the resale EC a more accessible housing option in this vibrant city-state.

Key Considerations When Applying for an EC Resale Mortgage

When considering the purchase of a resale Executive Condominium (EC) in Singapore, understanding the financing options available is paramount for prospective buyers. The process of securing a mortgage for an EC resale differs from that of a new unit due to its unique hybrid status between a public and a private condo. Prospective buyers should first assess their financial readiness, including income stability, existing debt commitments, and creditworthiness. These factors will influence the loan-to-value (LTV) ratio that banks are willing to offer, which in turn affects the monthly mortgage installments.

Buyers must also familiarize themselves with the different types of housing loans available, such as fixed-rate or floating-rate mortgages. The choice between these options hinges on one’s risk appetite and market outlook. Additionally, the loan tenure and the associated interest rates play a significant role in the overall cost of financing. It is advisable to compare offers from multiple financial institutions to identify the most favorable terms. Further, potential EC owners should consider the additional costs associated with resale units, such as the Legal & Certificate Fees (LAC), and ensure that they are prepared for these upfront payments. A thorough understanding of the total cost of ownership will help in making an informed decision when buying a resale EC in Singapore. Prospective buyers should also be aware of the Total Debt Servicing Ratio (TDSR) and Mortgage Service Ratio (MSR) regulations to ensure compliance with current housing finance policies, thereby avoiding any obstacles during the loan application process.

Step-by-Step Guide to Securing an EC Resale Loan in Singapore

In Singapore, purchasing a resale Executive Condominium (EC) can be a prudent step for individuals or families looking to secure a home with the potential for upgrading to a private condominium in the future. The process of securing an EC resale loan involves several key steps tailored to the financial landscape of Singapore. Prospective buyers should first assess their eligibility, which includes being Singapore citizens or permanent residents, meeting the minimum income requirements, and not owning more than one private residential property. Once eligible, potential buyers must identify their budget and the type of loan that suits their financial situation.

The journey to securing an EC resale loan begins with shopping around for the best mortgage rates. This is where a comparison of different financial institutions comes into play. It’s advisable to consider loans from banks, insurance companies, or even HDB-appointed finance companies. These institutions offer various loan packages, and comparing them can lead to significant savings over the tenure of the loan. After selecting a suitable loan package, applicants must prepare the necessary documentation, which typically includes financial statements, proof of income, and details of the resale EC unit they intend to purchase. Once the application is submitted, it undergoes evaluation based on the applicant’s creditworthiness and financial status. If approved, buyers can proceed with the legalities, valuation, and finally, the disbursement of the loan for the purchase of their resale Executive Condo in Singapore. Throughout this process, it’s crucial to work closely with a trusted mortgage broker or financial advisor who can guide you through the nuances of EC resale loans, ensuring a smooth and successful transaction.

When considering the purchase of a resale Executive Condo (EC) in Singapore, it’s crucial for potential buyers to have a comprehensive understanding of the market dynamics and available financing options. This article has provided an in-depth exploration of the EC resale market, outlined the various loan alternatives tailored for this unique housing type, and highlighted the key factors to consider when applying for an EC resale mortgage. With the step-by-step guide to securing an EC resale loan, buyers are now well-equipped with the necessary knowledge to navigate this process efficiently. For those looking to buy a resale Executive Condo in Singapore, this information serves as a valuable resource to make informed decisions and secure their dream home with confidence.