2023 presents a favorable time for individuals to consider purchasing a resale Executive Condominium (EC) in Singapore. Buyers should be aware of the specific eligibility criteria, including income ceilings and the requirement that at least one applicant must be a Singapore citizen. The remaining lease on an EC unit should have at least 20 years left post-acquisition for future lease extension considerations. It's also crucial to stay informed about any outstanding maintenance fees and the Minutes of Unit Owners' Meetings, as well as potential SERS or en bloc redevelopment plans that could impact the property's future. Financing options for an EC purchase in Singapore are diverse, with competitive interest rates and adaptable repayment terms available from various financial institutions, including the HDB loan. Additionally, 2023 is a great year to invest in an EC for renovation, with a focus on maximizing space through innovative design and multifunctional furniture. Personal touches and smart home technology will enhance both comfort and resale value, provided all renovations comply with HDB guidelines. For those interested in 'Buying Resale Executive Condo Singapore,' this year offers unique opportunities for personalization and investment growth.

2023 presents a pivotal year for prospective homeowners in Singapore, particularly those considering the purchase of a resale Executive Condominium (EC). This article delves into the multifaceted aspects of acquiring a resale EC, offering insights into its value proposition and the nuances of eligibility. We guide you through the process, from understanding the market trends to navigating financing options and legal requirements. Whether you’re looking to maximize your living space or seeking the perfect blend of affordability and convenience, this comprehensive guide on Buying a Resale EC in Singapore 2023 will equip you with the knowledge necessary for making an informed decision.

- Exploring the Value of Buying a Resale Executive Condominium (EC) in Singapore 2023

- Understanding the Benefits and Eligibility Criteria for Resale ECs in Singapore

- The Step-by-Step Process of Purchasing a Resale EC: A Guide for Buyers

- Market Trends: Analyzing Resale EC Prices and Locations in Singapore 2023

- Financing Your Resale EC: Options and Tips for Prospective Homeowners

- Legal Considerations When Buying a Resale Executive Condominium in Singapore

- Maximizing Your Living Space: Tips for Renovating and Personalizing Your Resale EC

Exploring the Value of Buying a Resale Executive Condominium (EC) in Singapore 2023

In 2023, the Singaporean property market continues to offer attractive opportunities for potential homeowners, particularly in the realm of Executive Condominiums (ECs). Among these, buying a resale EC presents a compelling value proposition. Unlike new EC launches, which come with a minimum occupation period and are subject to the pricing constraints set by the government, resale ECs offer immediate occupancy and potentially lower entry costs. Prospective buyers have the advantage of inspecting the property firsthand, assessing its condition and location, which can influence their decision significantly. The resale market also provides a diverse selection of mature estates, where amenities, infrastructure, and transportation links are already well-established. This maturity translates to convenience and a higher likelihood of capital appreciation over time.

Moreover, purchasing a resale EC in Singapore is advantageous due to its eligibility criteria. Unlike new ECs which are only available to first-time applicants, resale ECs can be purchased by second-timers, provided they fulfill the specific requirements set forth by the Housing & Development Board (HDB). This inclusivity makes resale ECs a suitable option for a broader demographic of Singaporeans. Additionally, the resale market allows for more flexible financing options, enabling buyers to tailor their mortgage terms according to their financial situation. With the right guidance and thorough research, acquiring a resale Executive Condominium in 2023 can be a strategic move for those looking to enjoy the benefits of condo living while leveraging the value and established charm of an already settled property.

Understanding the Benefits and Eligibility Criteria for Resale ECs in Singapore

Buying a resale Executive Condominium (EC) in Singapore can be an attractive option for couples or families looking to upgrade from a public housing flat. Unlike new ECs, resale ECs offer the benefit of immediate availability and maturer estates, providing an immediate sense of community and potentially higher capital appreciation due to their established locations. Prospective buyers have the advantage of inspecting the unit beforehand, understanding the neighbourhood better, and enjoying living facilities akin to private condominiums. The eligibility criteria for purchasing a resale EC are distinct from those buying new units. To be eligible, applicants must meet the following requirements: at least one applicant must be a Singapore citizen, the average monthly household income should not exceed S$14,000, and applicants must have a minimum of S$30,000 in savings to cover the downpayment and other expenses. Additionally, owners must have fulfilled the 5-year minimum occupation period (MOP) before they can sell their EC on the open market. Prospective buyers interested in buying a resale EC in Singapore should consider these benefits and criteria carefully to ensure a smooth transaction and to make an informed decision that aligns with their long-term housing plans. The process of purchasing a resale EC is facilitated by the Sale of Executive Condominium (EC) Scheme, which allows for a smooth transition into ownership of these versatile homes. Understanding the nuances of this scheme and how it fits with your financial situation is crucial for a successful purchase in the dynamic property landscape of Singapore.

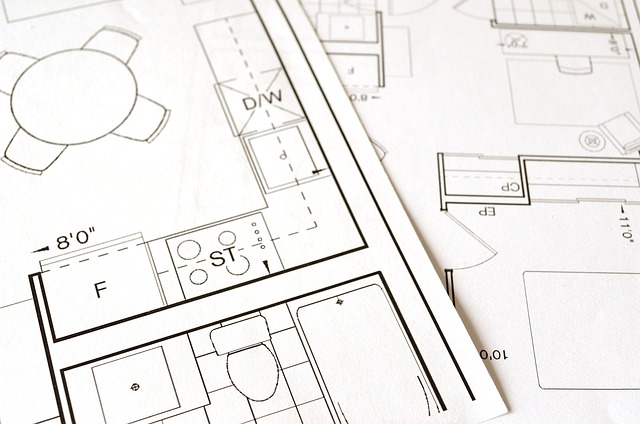

The Step-by-Step Process of Purchasing a Resale EC: A Guide for Buyers

Embarking on the journey to purchase a resale Executive Condominium (EC) in Singapore involves a well-defined process tailored for eligible applicants. Prospective buyers must first ascertain their eligibility by satisfying the criteria set out by the Housing & Development Board (HDB). Once eligibility is confirmed, the buying process can proceed with the following steps. Initially, potential buyers should identify an EC that fits their preferences and budget. The Singapore Resale Price Index and recent transaction prices serve as valuable guides for market trends. Upon finding a suitable unit, one must engage the services of a solicitor or a property lawyer to manage the legalities of the purchase. This professional will guide the buyer through the necessary application for an Option to Purchase (OTP) with the seller. The OTP is a binding agreement that allows both parties to commit to the transaction exclusively, for a stipulated period.

Post-OTP acquisition, buyers are to inspect the property thoroughly and confirm its condition. This due diligence phase is crucial as it involves understanding the EC’s aging and any potential maintenance costs. Buyers must also ascertain that the unit meets the required standards set by the HDB for resale ECs. Once the property is deemed satisfactory, the buyer proceeds with the financial arrangements, which include securing a mortgage or preparing the full payment if unencumbered by financing needs. The final step involves submitting all necessary documents to the HDB for approval of the resale application. Upon approval and successful payment or loan commitment, the transfer of the EC unit takes place. Throughout this process, buyers should liaise closely with their solicitor and real estate agent to navigate each step efficiently, ensuring a smooth transition into EC living in Singapore’s vibrant housing market.

Market Trends: Analyzing Resale EC Prices and Locations in Singapore 2023

In 2023, the resale Executive Condominium (EC) market in Singapore has displayed a dynamic trend, with prices and locations reflecting a nuanced understanding of the city-state’s real estate landscape. Prospective buyers interested in ‘Buying Resale EC Singapore’ are advised to monitor resale prices closely, as they have been influenced by a variety of factors including the maturity of the estate, proximity to amenities, and the overall economic climate. Notably, resale ECs located in established neighborhoods with well-connected transport links have seen a rise in demand, often leading to an uptick in prices. For instance, ECs situated near regional centers like Tampines or Sengkang, which offer comprehensive living solutions and are slated for further development, have become attractive investment opportunities. Additionally, the resale market has been impacted by policy changes, with the introduction of new measures to curb speculative buying and ensure stable housing growth. As a result, savvy investors and homeowners alike are keenly analyzing past trends and current policies to make informed decisions about their purchases in this competitive segment of Singapore’s property market. When considering ‘Buying Resale EC Singapore,’ it is crucial to evaluate both the immediate environment and the long-term prospects of an area, as these factors will significantly influence the resale value and liveability of the EC.

Financing Your Resale EC: Options and Tips for Prospective Homeowners

When considering the purchase of a Resale Executive Condominium (EC) in Singapore, financing your acquisition is a critical aspect to navigate. Prospective homeowners have several options when it comes to securing a loan for their EC purchase. One of the primary choices involves opting for a bank loan or a housing loan from a financial institution. These loans typically come with competitive interest rates and flexible repayment tenures, allowing buyers to tailor their financing to suit their financial situation. Another option is the Housing & Development Board (HDB) loan, also known as the Concessionary Home Mortgage Scheme (CHMS), which offers more favorable terms but is limited to a certain property price cap and cannot be used in combination with other housing grants.

To maximize your chances of securing a favorable loan for Buying Resale EC Singapore, it’s advisable to start early by checking your eligibility criteria and understanding the different loan options available. Prospective buyers should also have a clear idea of their financial commitments and monthly income to determine an affordable loan amount. Additionally, a good credit score can significantly enhance your borrowing power and may lead to better loan terms. It’s prudent to compare interest rates and loan features from different financial institutions, as well as to consider the total cost of ownership which includes additional costs such as legal fees, stamp duty, and maintenance fees. By carefully planning and leveraging available resources, buying a resale EC in Singapore can be an achievable milestone on your property journey. Remember to engage with experienced property consultants or financial advisors who can guide you through the process of securing the right financing for your resale EC purchase.

Legal Considerations When Buying a Resale Executive Condominium in Singapore

When considering the purchase of a Resale Executive Condominium (EC) in Singapore, legal considerations are paramount to ensure a smooth transaction and to avoid any potential complications post-purchase. Prospective buyers must be aware that ECs have unique eligibility criteria, which differ from those for public housing flats and private condominiums. For instance, at least one applicant must be a Singapore citizen, and all applicants must earn a combined monthly income of not more than SGD14,000 or less (as per the Housing & Development Board’s regulations in 2023). This stipulation is subject to change, hence it’s crucial to stay updated on the latest income ceilings and eligibility requirements.

Additionally, when buying a resale EC, it’s important to consider the remaining lease and any pending enhancements or selective en bloc redevelopment (SERS) plans. The remaining lease must be at least 20 years upon acquiring the unit to ensure that you can apply for the extension of lease when eligible, thus ensuring long-term living prospects. Also, potential buyers should review the Minutes of Unit Owners’ Meetings and check if there are any outstanding or deferred maintenance and conservation fees (MCST) matters that could affect the resale price or future repairs and renovations. By thoroughly understanding these legal nuances, buyers can make informed decisions and navigate the purchase of a Resale Executive Condo in Singapore with greater confidence.

Maximizing Your Living Space: Tips for Renovating and Personalizing Your Resale EC

When considering the purchase of a resale Executive Condo (EC) in Singapore for 2023, maximizing your living space is a key factor that can significantly enhance your quality of life. Renovating your new EC to suit your personal preferences and lifestyle needs is an excellent way to create a home that’s uniquely yours. To begin with, assess the current layout and identify areas that can be reconfigured to better fit your daily activities. For instance, opening up the floor plan or creating larger communal spaces might be priorities if you enjoy entertaining guests. Utilize space-saving solutions such as multifunctional furniture and clever storage options to make the most of every square foot.

In terms of personalization, consider incorporating elements that reflect your tastes while keeping in mind the timeless appeal of classic designs. Choose materials and finishes that are both durable and easy to maintain, ensuring longevity and resale value. Lighting plays a crucial role in setting the ambiance; therefore, invest in versatile lighting solutions that can be adjusted according to your needs. Smart home technology integration is another aspect to consider; it not only adds convenience but also enhances the property’s appeal. By thoughtfully combining practical renovations with personal touches, your resale EC will become a comfortable and functional haven tailored to your unique lifestyle. Remember to adhere to HDB’s guidelines for renovation to avoid any complications post-purchase. With careful planning and creative design, your EC can become a space that not only meets but exceeds your expectations.

When contemplating the purchase of a residential property in Singapore, particularly a Resale Executive Condominium (EC) in 2023, it is evident that such a decision carries significant financial and lifestyle implications. The insights provided in this article offer a comprehensive guide for prospective homeowners looking to buy an EC, encompassing the value proposition of resale units, eligibility criteria, purchase processes, market trends, financing options, legal considerations, and renovation tips. By understanding these facets, buyers can make informed decisions that align with their long-term housing goals in Singapore. The resale EC market presents a unique opportunity for individuals and families to own a spacious and centrally located home at an affordable price point, which is particularly valuable in today’s real estate landscape. Prospective buyers should carefully consider the guidance presented herein when navigating the purchase of a Resale Executive Condominium in Singapore, ensuring a smooth and rewarding experience.